Legislative Update

Reinstating FCC Form 395-B Reporting on the Race and Gender of Broadcast Employees – What the Action Means for Broadcasters

On February 22, the FCC released an Order reinstating the requirement for radio and television broadcasters, commercial and noncommercial, to annually file an FCC Form 395-B. All station employment groups with 5 or more full-time employees would need to classify all station employees, both full-time and part-time, by race or ethnicity and gender, as well as by the type of job they perform at the station.

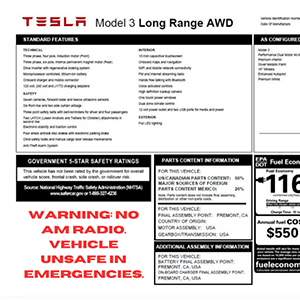

Read MoreGottheimer Announces New Action Against Automakers Discontinuing AM Radio in Electric Vehicles

On January 29, 2024, U.S. Congressman Josh Gottheimer (NJ-5) announced new action to protect AM radio in electric vehicles and ensure potential buyers know which cars and trucks have AM radio and those that don’t. AM radio is a vital public safety and emergency management tool that has served as the sole lifeline during times of crisis like 9/11, Hurricane Sandy, and other major storms and floods.

Read MoreNAB Applauds Commission Proposal to Address Regulatory Fee Disparity

“NAB applauds the FCC for its hard work to ensure that its regulatory fee process allocates fees in a more fair and equitable way. This year’s order is a significant step toward ensuring all parties that benefit from the FCC’s work pay their fair share.”

Read MoreArtificial Intelligence in Political Ads – Legal Issues in Synthetic Media and Deepfakes in Campaign Advertising – Concerns for Broadcasters and Other Media Companies

Stories about “deepfakes,” “synthetic media,” and other forms of artificial intelligence being used in political campaigns, including in advertising messages, have abounded in recent weeks.

Read MoreJuly Regulatory Dates for Broadcasters – Quarterly Issues/Programs List, Franken FMs, Copyright Distant Signal Copyright Claims, and More

July is relatively light on broadcast regulatory dates, but the Quarterly Issues/Programs List deadline on July 10 is one that applies to all full-power broadcasters and Class A TV stations. As set forth below, there are a few other dates worth noting this coming month – with more to come in August.

Read MoreFCC’s ATSC 3.0 Order Takes Long-Awaited Steps to Facilitate Multicast Hosting Arrangements

Last Friday (6/23), the FCC released a Third Report and Order and Fourth Further Notice of Proposed Rulemaking (Multicast Licensing Order), setting forth rules regarding Next Gen multicast hosting arrangements and seeking further comment on ATSC 3.0-related patent issues.

Read MoreAM For Every Vehicle Act Introduced In Congress

RadioInk reports that a bipartisan coalition in the United States Congress has introduced the AM for Every Vehicle Act – legislation that would require federal regulators to mandate AM radio in new vehicles without an additional charge.

Read MoreFCC Repeals COVID-Era Accommodation that Allowed Broadcasters to Offer Businesses Free Advertising Time Without LUC Implications

On May 15, the FCC’s Media Bureau released a Public Notice announcing that it was repealing the COVID related guidance released in March 2020 that allowed broadcasters, local cable operators, and other media companies subject to the requirements that political candidates be offered Lowest Unit Rates during pre-election periods, to offer free advertising time to advertisers and other local businesses without those spots being considered in calculating the LUC during the periods that these spots were running.

Read MoreFCC Regulatory Fees May Be Going……Down!

InsideRadio reports that after four consecutive years of paying more in annual regulatory fees, the radio industry is in line for a rollback this year. Under a proposal drafted by the Federal Communications Commission, most stations would see their annual fee shrink by five percent – but some of the smallest stations could see a reduction of as much as 43%.

Read MoreReminder About Broadcasters’ FCC EEO Obligations After the April’s First 2023 Audit of Station Performance

We thought that we should post our customary article describing the audit requirements and the basics of the FCC EEO rules as a reminder to all stations as to their general FCC EEO obligations. The FCC has promised to randomly audit approximately 5% of all broadcast stations each year. As the response (and the audit letter itself) must be uploaded to the public file, it can be reviewed not only by the FCC, but also by anyone else with an internet connection anywhere, at any time.

Read More